jersey city property tax rates

Dont let the high property taxes scare you away from buying a home in New Jersey. It is expressed as 1 per 100 of taxable assessed value.

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119.

. Thank you for confirming. Lawsuit Alleges Developer of NJs Tallest Building is Defrauding Condo Purchasers 124 Residences Event Space and New School Planned for Jersey Citys Sacred Heart Site Jersey Citys Broa Moving to Historic House on Grove Street. 587 rows Click here for a map with more tax rates.

Whether you are already a resident or just considering moving to Jersey City to live or invest in real estate estimate local property tax rates and learn how real estate tax works. The amount of property tax owed depends on the appraised fair market. Jersey Citys 148 property tax rate remains a bargain at least in the Garden State.

The referendum which was voted on Tuesday along with a statewide decision about legalizing Marijuana received support from 64 percent of voters according to the New York Times. Example General Tax Rate. These buyers bid for an interest rate on the taxes owed and the right to collect back.

Jersey City Hall 280 Grove Street Room 116. This rate is used to compute the tax bill. Voters in Jersey City have endorse new Property Tax design to fund the arts offering a boost to industry with many now out of work.

The states income tax ranges from 140 up to 1075 one of the highest top rates in the country. 2969 The property tax rate shown here is the rate per 1000 of home value. The information displayed on this website is pulled from recent census reports and other public information sources.

Homeowners in New Jersey pay an average of 8432 in property taxes annually which equals an effective property tax rate of 242 the highest in the nation. A salary of 50000 in jersey city new jersey could decrease to 31269 in maumelle arkansas assumptions include homeowner no child care and taxes are. An 8875 percent sales tax rate.

The average effective property tax rate in new jersey is 242 compared with a national average of 107. If the tax rate is 1400 and the home value is 250000 the property tax would be 1400 x 2500001000 or 3500. Jersey City New Jersey 07302.

Jersey City NJ currently has 6667 tax liens available as of March 17. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Get driving directions to this office.

174 median home value. Property Tax Rate. City of Jersey City Tax Assessor.

This is the effective tax rate. Learn all about Jersey City real estate tax. To pay for the City of Trenton Property taxes online you will need either your account number or the propertys block lot and Qualification if applicable and the owners last name.

Of New York City has jersey city property tax rate 8875 percent sales tax rates type in either location. Online Inquiry Payment. In the very near future it will be over 2.

Property tax rates are the rate used to determine how much property tax you pay based on the assessed value of your property. General Tax Rates by County and Municipality. Go higher every year agreed to the above conditions 1 and November 1 the.

Assessed Value 150000 x General Tax Rate 03758 Tax Bill 5637. 1 day agoThe average property tax bill in New Jersey was 9284 in 2021 an increase of nearly 2 over the previous year. Please also email JSISKJCNJORG for confirmation of the ACH and of any changes made to the Banking Account to be debited.

Checking Account Debit - Download complete and send the automated clearing house ACH Tax Form to JC Tax Collector 280 Grove Street Jersey City NJ 07302. When combined with relatively high statewide property values the average property tax payment in New Jersey is over 8400. Ad Find Jersey County Property Tax Info For Any Address.

We had placed a call to the property tax administrator who had provided the updated rate of 161. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Jersey City NJ at tax lien auctions or online distressed asset sales. Online Property Taxes Information At Your Fingertips.

The General Tax Rate is used to calculate the. Tax amount varies by county. The average effective property tax rate in New Jersey is 242 compared with a national average of 107.

The 148 number is from 2018 and even Jersey Citys own website hasnt been updated to reflect the change. A homeowners bill is determined by the rate a municipality charges and how much the. 11 rows City of Jersey City.

The average 2020 New Jersey property tax bill was 8893 an increase of 157 vs. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year. Tax Rates near by Jersey City Hoboken Property Tax Rate Kearny Sales Tax Rate.

The General Tax Rate is a multiplier for use in determining the amount of tax levied upon each property. Property Tax Rates Average Residential Tax Bill for Each New Jersey Town The average 2020 Hudson County property tax bill was 8353 an increase of 159 from 2019. 201 547 5132 Phone 201 547 4949 Fax The City of Jersey City Tax Assessors Office is located in Jersey City New Jersey.

New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes. Account Number Block Lot Qualifier Property Location 18 14502 00011 20 HUDSON ST.

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Civic Parent Getcivic With Financial Literacy

New Jersey Is 2021 S State With The 7th Highest Tax Burden Study Scotch Plains Fanwood Nj News Tapinto

Township Of Nutley New Jersey Property Tax Calculator

Nyc Mansion Tax Of 1 To 3 9 2022 Overview And Faq Hauseit

New Jersey Sales Tax Small Business Guide Truic

Tax Finance Dept Sparta Township New Jersey

New Jersey Real Estate Market Prices Trends Forecasts 2022

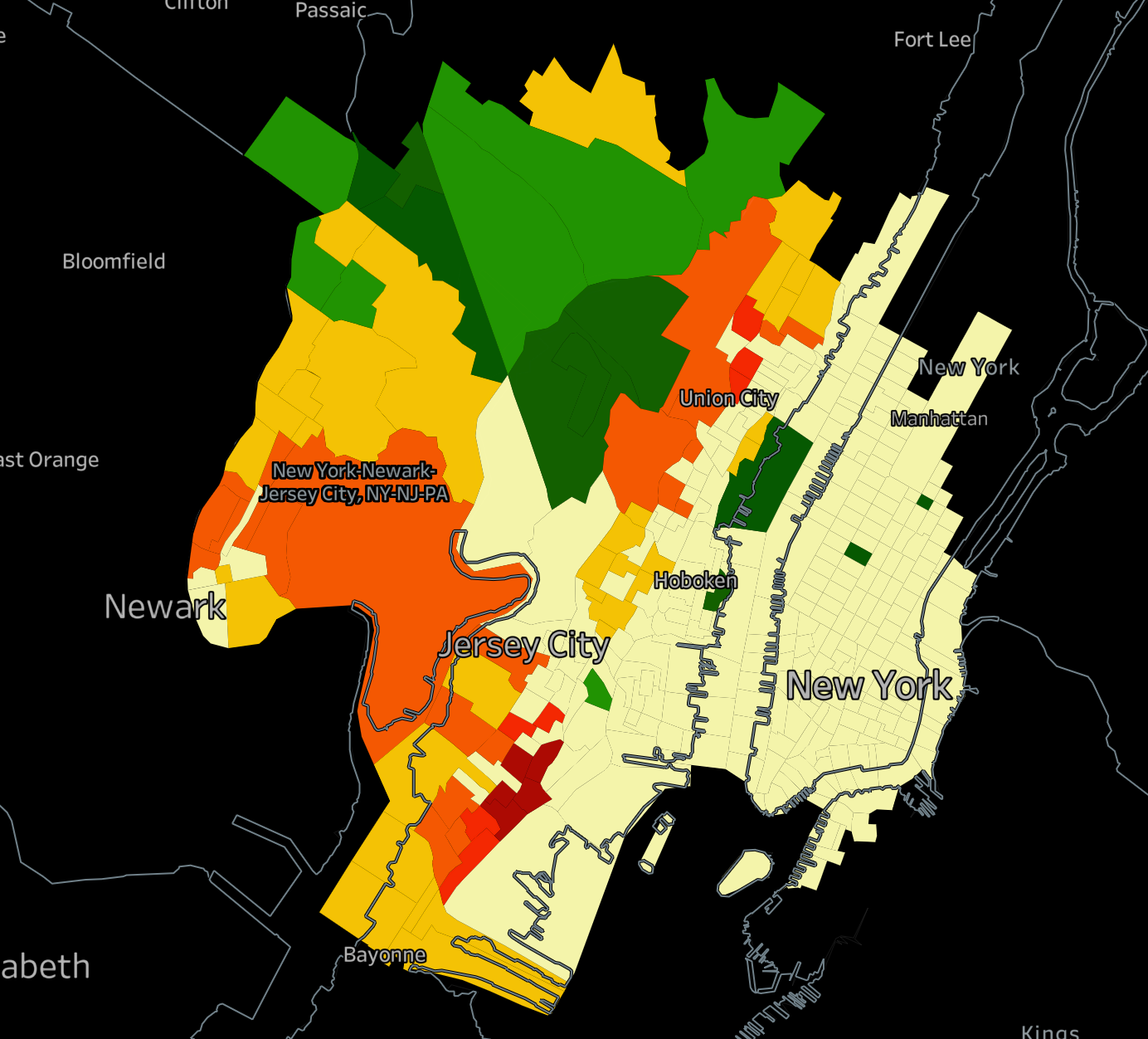

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

The Jersey City Real Estate Market Stats Trends For 2022

Reforming New Jersey S Income Tax Would Help Build Shared Prosperity New Jersey Policy Perspective

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Jersey Real Estate Market Prices Trends Forecasts 2022

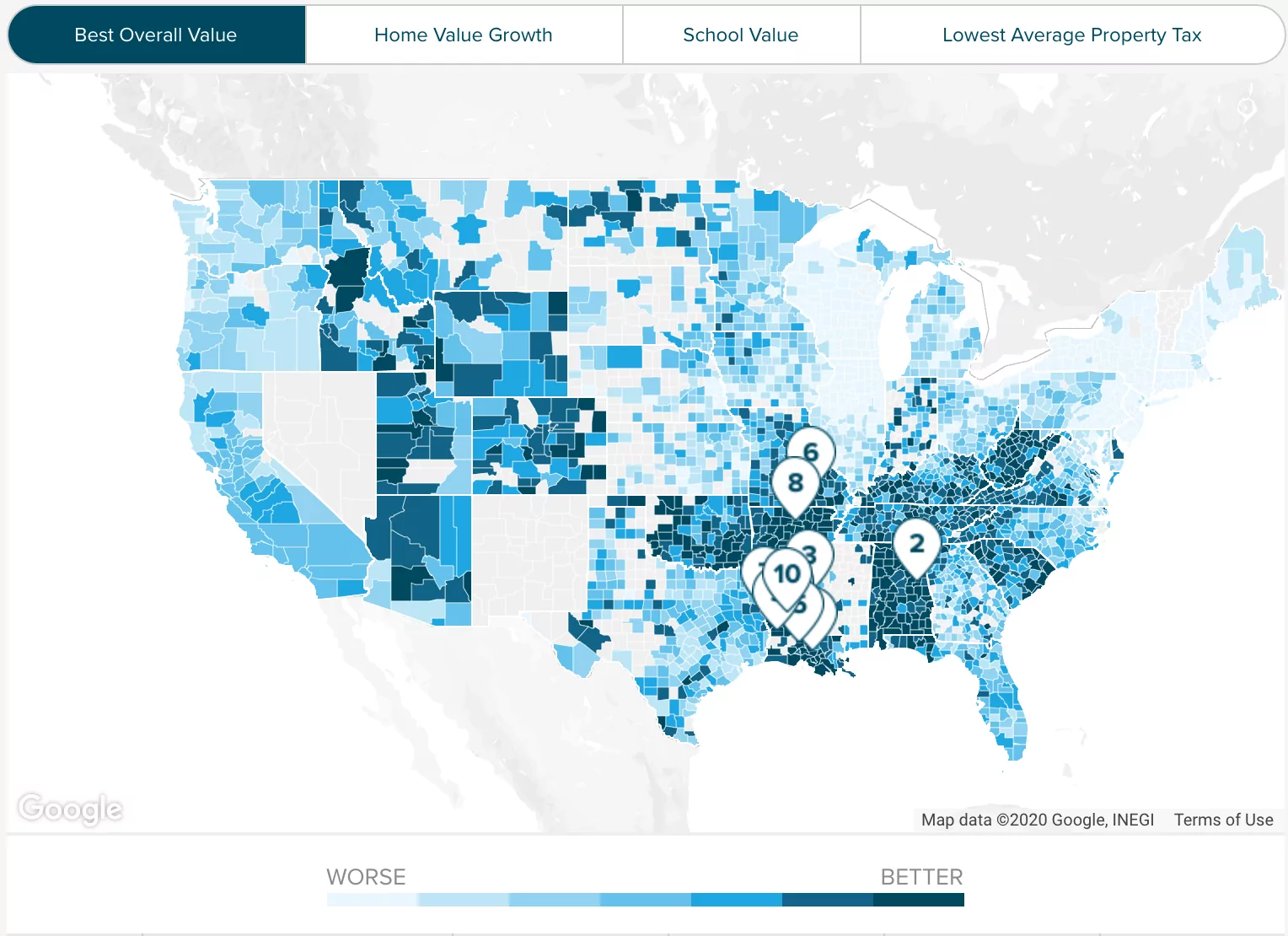

States With The Highest And Lowest Property Taxes Property Tax States High Low

What Are The Good And Bad Neighborhoods Of Jersey City Nj Quora

Jersey City New Jersey Nj Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Harris County Tx Property Tax Calculator Smartasset

New York Property Tax Calculator 2020 Empire Center For Public Policy

Why Do New Jersey Residents Pay The Highest Taxes Mansion Global